By Harry Clarke, Head of Insight & Analytics

To spot the most interesting trends from 2023, I looked a bit deeper into sourcing and pricing trends that can help operators and brokers make more data-driven decisions for their business in 2024.

Aircraft lifespan is growing

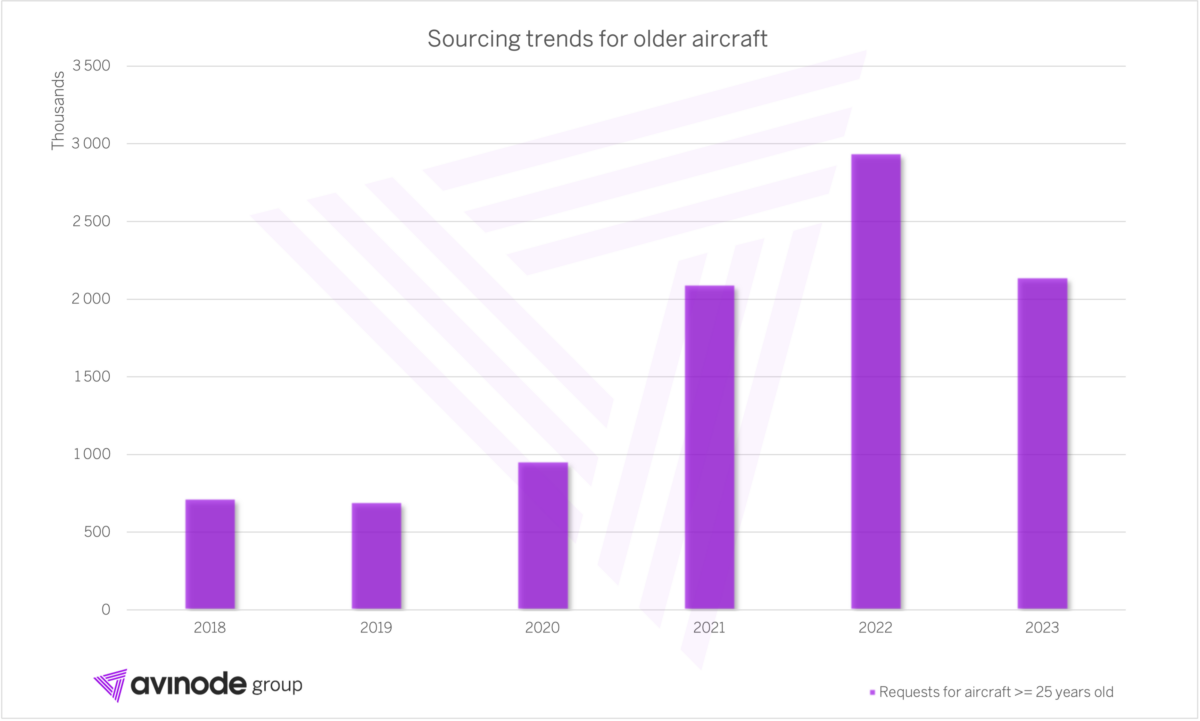

As every year, new aircraft are constantly added to Avinode. However, we hear from operators that older aircraft are still highly requested. Avinode data on charter activity in Europe, the US, and Canada confirms this, showing the continuing value of older aircraft in all markets, with a slightly younger fleet in Europe.

In the below graph, we can see that aircraft that are 25 years or older got more Avinode requests in recent years, suggesting that older aircraft have a longer lifespan than before.

With increasing costs for charter in general and increasing rates, maybe an older aircraft is a more attractive choice for charter? Has COVID-19 led to a more price-conscious client group entering the market? It could also be a result of the ongoing aircraft shortage, predicted to continue until 2026 according to SMBC Aviation Capital. These are trends to consider for any operator looking to add to their fleet.

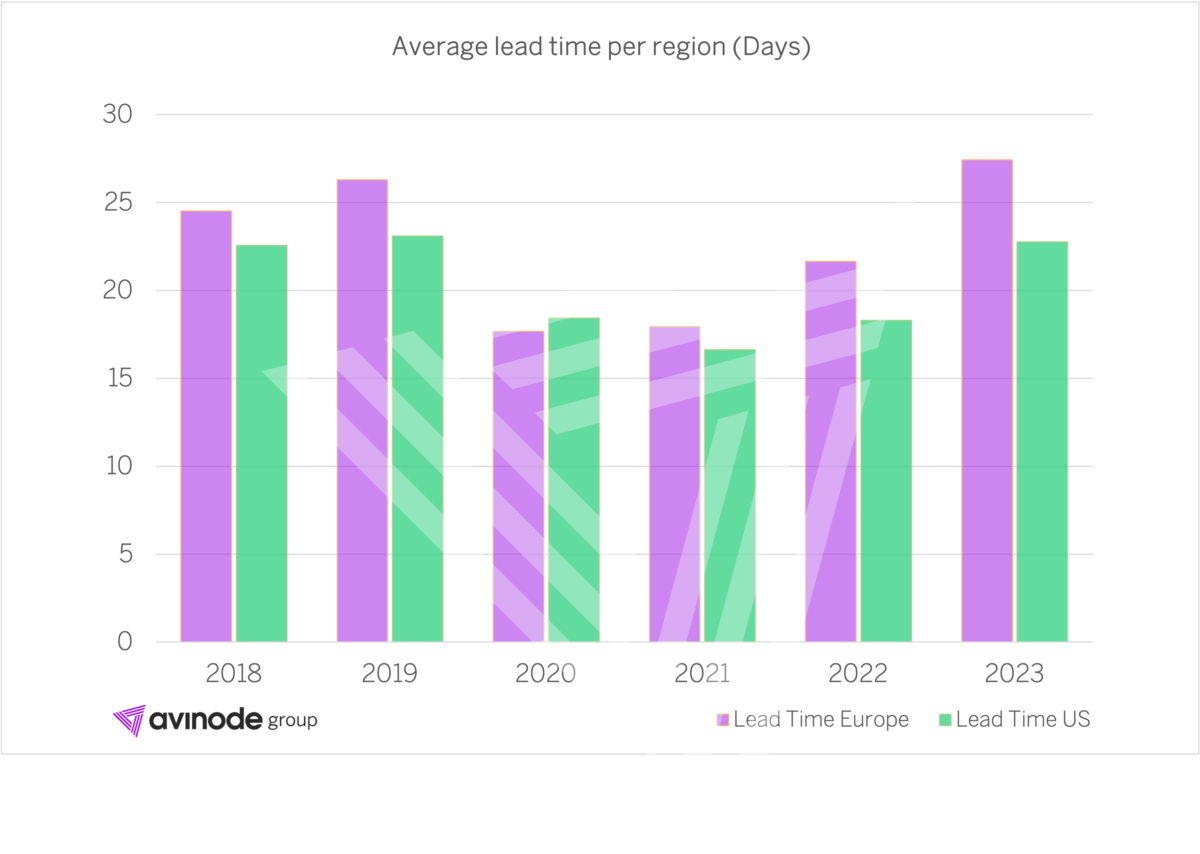

Going back to normal lead times

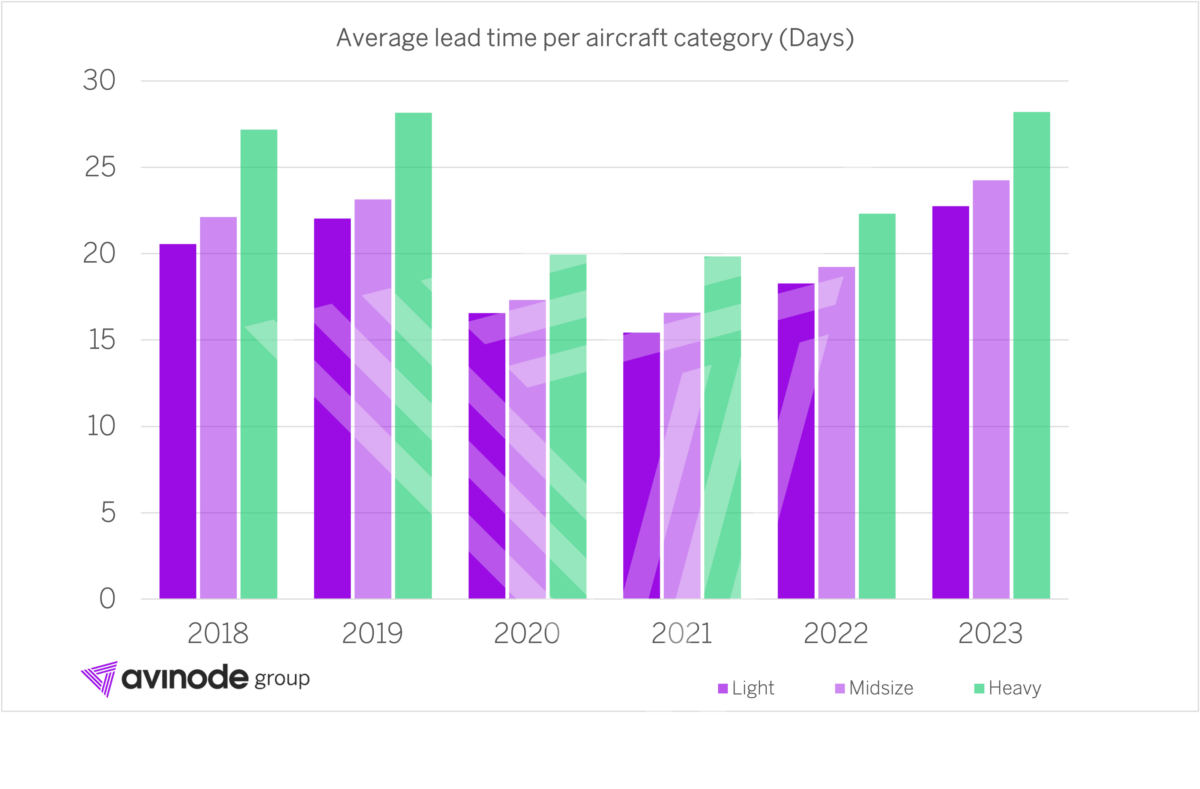

As we’ve reported previously, the global pandemic led charter brokers to request trips with a much shorter notice. Avinode data for 2023 now shows that charter clients plan their trips further in advance, resulting in longer notice for the operator scheduling the trip. We are clearly on the way back to pre-pandemic levels with lead times averaging at around 25 days in 2023, thanks to an increase in trips being planned much further in advance.

For heavy jets, there was a more dramatic drop in lead times in 2020 compared to other aircraft categories, and a slightly slower return. Charter sales teams that are used to a large proportion of last minute demand should consider this trend in their planning for 2024 as it might require a change in behavior.

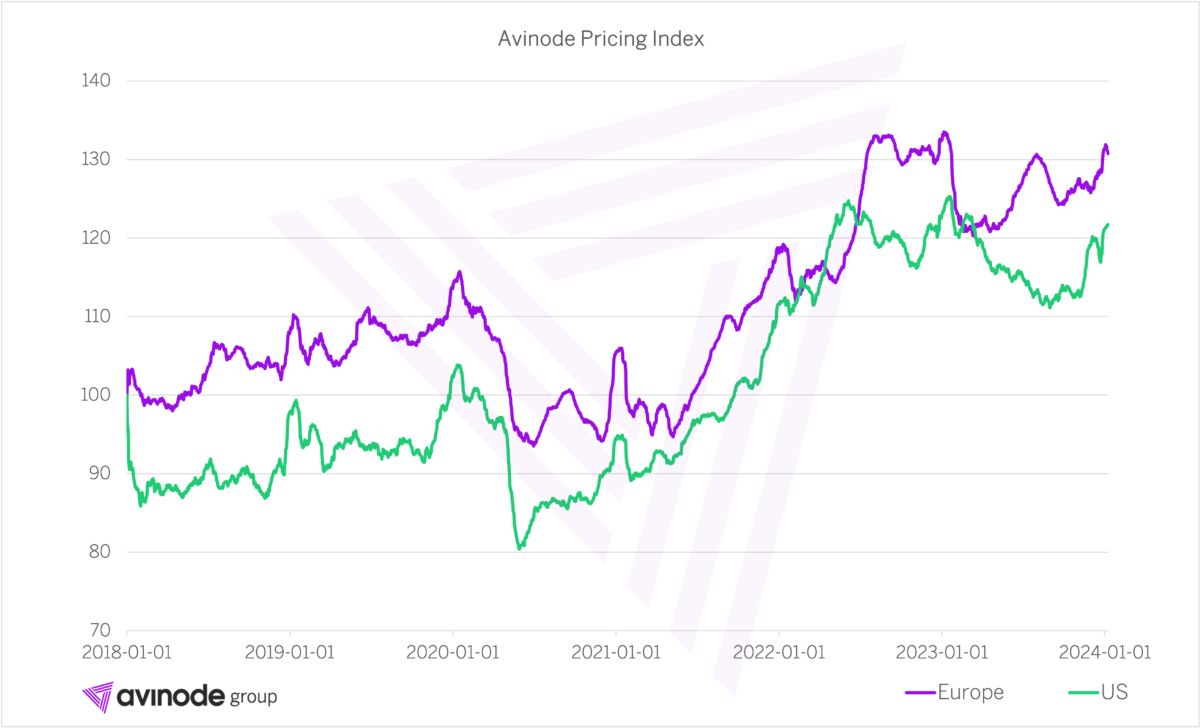

2023 charter rates are flat

Charter rates decreased in the first half of 2023, having been elevated for about a year. With higher rates during the autumn and winter, the year ended up almost flat. This trend is the same across different aircraft types.

In Europe, we can however see a slight seasonal increase during the summer of 2023, while the US prices stayed lower throughout the year. Both markets ended the year on a higher note.

What will be fueling the trends in 2024?

In our conversations with members we learn a lot about the market developments that are affecting their business. With our data, we can provide an extra layer of insights that help our member make the right decisions. How will new demand, fuel prices, FBO costs and jet cards affect the charter rates moving forward? In the end, it’s when we meet members and industry peers to discuss these market developments and our different perspectives that we can draw conclusions together.

We can’t wait to see where this takes us in 2024!

Stay on top of charter trends with our reports.

Stay informed with the latest insights into Avinode demand and charter rates. In our Buinsess IQ webshop you can find just the right report, or order a custom report, to fuel your next important decision.