“Leisureav” the first to recover

For starters, the pandemic has taken much of the “business” out of business aviation, with an abrupt stop to in-person meetings. Mid-week flights dropped off sharply in April, and have been very slow to recover even as lockdowns have lifted.

Armando says of customers in Florida, “Previously, when people had to be somewhere for a meeting, they would have no option but to fly on a specific date and time. With things the way they are now, everybody is taking things slower.”

The days that have recovered best are the days that are typically leisure travel — the weekends. Tuesdays and Wednesdays are still lagging behind. This is unlikely to reach previous levels any time soon, with workforces successfully making the transition to remote work structures and staying like that — potentially for years to come. In its stead, we’re seeing leisure travel and other forms of “optional” travel. This includes getting a vacation in, going to see family, or moving from one home to a second home.

Florida’s spike

These optional and semi-optional reasons for travel can explain the spike in traffic between Florida and the northeast United States.

Reflecting on trends in the Avinode system, Harry Clarke (Head of Insight & Analytics at Avinode) says, “We’ve seen a lot of demand from Florida. There were a lot of people in the Northeast who went down to Florida, and there are a lot trying to get back up north. It’s hard to know if the normal ‘popping down for the weekend’ is back or if people are still staying put but just trying to find what the prices are to return.”

The increase in demand can also be a reaction to the spread of the coronavirus. As Armando surmises, “We have a high number of cases down here in Florida. Maybe because of that, people just want to get out. But it could also be that people have vacation places down here and big properties with a lot more space to quarantine than other places like New York.”

It is likely that demand from Florida is spiking for all of these reasons, not just one of them. It’s a complex landscape, with varying motivations to fly. But one thing is clear: if someone is going to get on an airplane, it’s much safer and more convenient to charter a flight. Which has led to new interested parties.

The hunt for empty legs

Armando reports, “We’ve been getting a lot of interest from people who have never flown private before. The consequence is that people think that money-wise it’s just going to be twice or three times as expensive as an airline ticket. So, when they see the actual price they say: ‘Wow, this expensive.’”

The sticker shock has led many brokers to hunt for empty legs for these new clients. Since their travel is optional, it helps that they have more generous time frames.

“I’ve been seeing a lot more flexibility in the time frames that the customers can fly. Now they will give us a range of days. When they are flexible, that gives us more time for a margin and to find an empty leg,” says Armando. In short: more time to find them a good deal.

How the changes show up for us

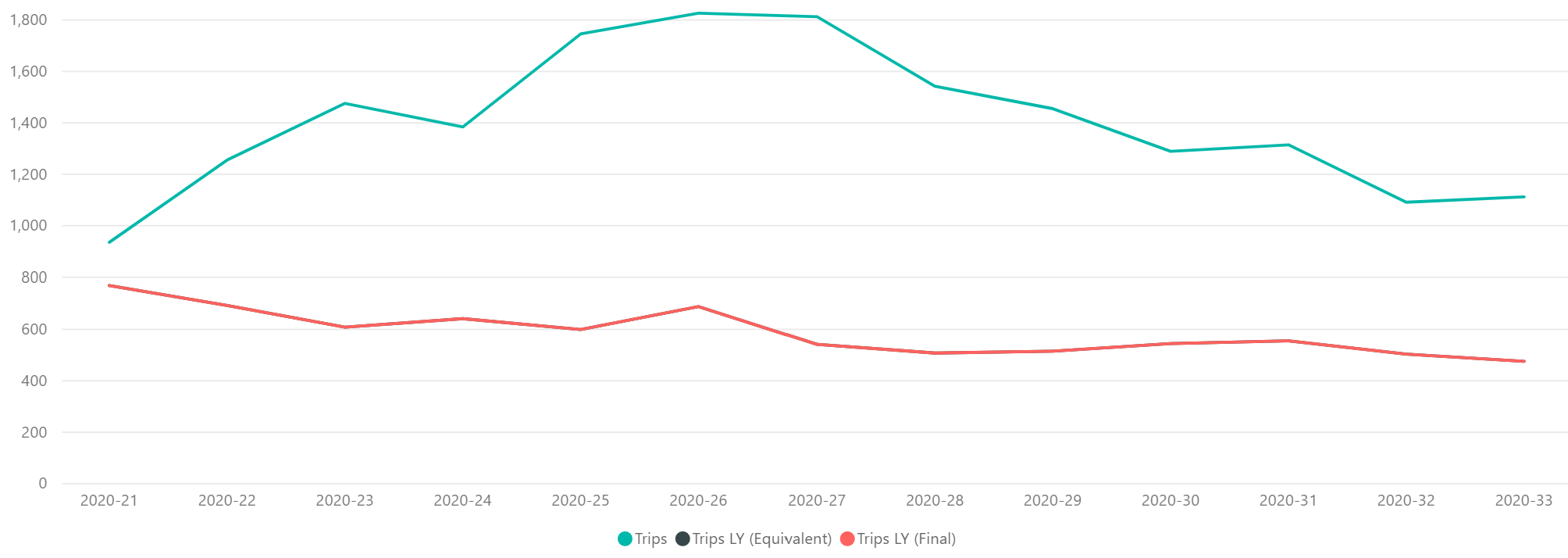

Over this 2020 summer, we’ve welcomed a sizable increase in Avinode members. We can attribute this to the need to present more charter options to a new, price-sensitive clientele. In fact, in July we saw a 21% increase in requests compared to last year. While these are just requests and don’t necessarily reflect flights booked, it does point to expanded interest in private charter.

As Harry says, “I think if there are a lot of new customers coming into the market — new end clients — they’re going to search more and try out more options. For their existing customers, brokers are likely to have a set of operators they typically use. Whereas for a brand new customer, maybe there’s less certainty and they want to provide a range of options.”

How does the fall look?

The prospects for the fall vary between the US and Europe, with things looking slightly better for the US. Brokers and operators in the US enjoy a longer window to make a recovery, as travel tends to continue quite steadily into the autumn and winter. In contrast, Europe-based outfits typically have the tail end of summer to cash in for the whole year. August saw a bump in travel, with European vacation-goers trying to squeeze in a bit of beach time.

Countries with a large amount of domestic travel stand to do better going into the fall. This was evidenced in Russia throughout August, where a relaxation in restrictions gave way to a spike in travel second only to that seen for the 2018 FIFA World Cup. Here again the singular market of the US will be easier to navigate than in Europe, where travelers need to gauge more complex restrictions that vary from country to country.

Lastly, everything really depends on the spread of COVID-19 and resulting government restrictions. Colder weather, with more people on public transportation and spending time in indoor spaces, could see lockdowns return and travel drag to a halt.

A tough year

Despite the promising entrance of some new customers into the bizav space, there is no denying: this was an incredibly tough year for bizav. In the short term, these new customers will not be able to offset the drop in business travel. But an opportunity is an opportunity, and it will be interesting to see what this customer conversion rate is in the coming months.