Approaching the temporary normal

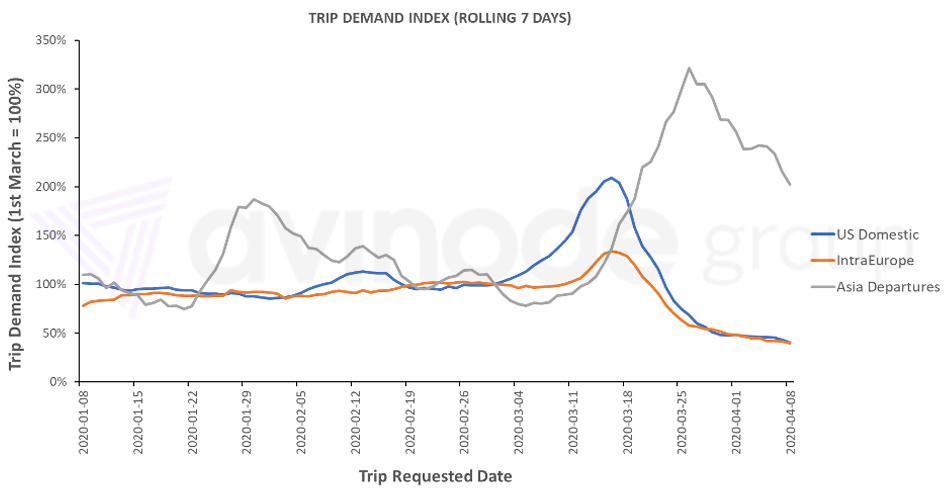

The chart below is a rolling 7-day index of demand, normalised to 1st March, for trips requested through the Avinode marketplace. It shows that both US domestics (blue) and intra-European flights (red) have flattened since their drastic decline after the mid-March spike. Whilst demand for private charter in these two major markets is clearly low, demand appears to be approaching its temporary “normal” level.

Also shown is charter demand for departures from Asia (grey). The recent spike there has been larger than the initial COVID-19 spike in January but appears to be slowing down now. Elsewhere, departure and arrival demand for Africa is up, with demand spread across the continent, apart from tourism driven Morocco.

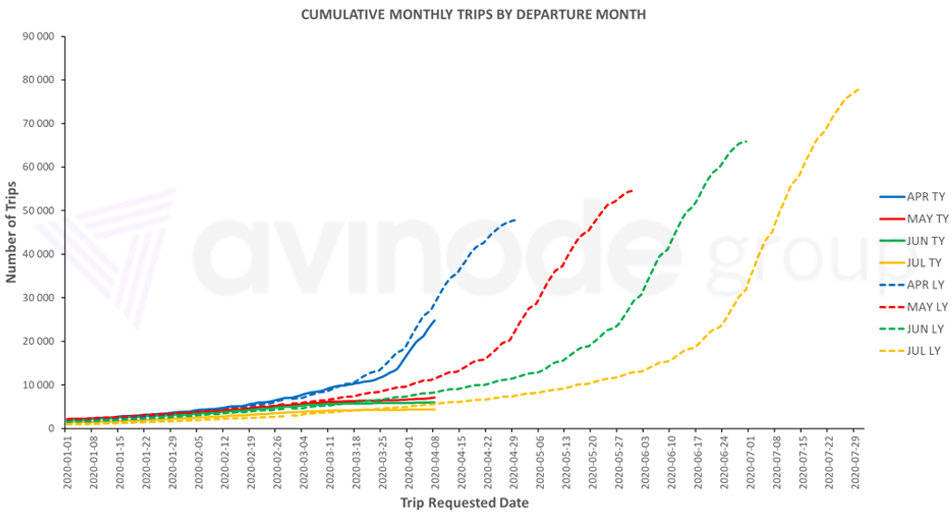

Cumulative trips by departure month

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. Demand for departure in April (blue) is 14% below what is was at the equivalent time last year. Looking further out, May (red) is 38% below where we would expect it to be in normal demand conditions. There is still lots of time to recover summer demand, when restrictions allow.

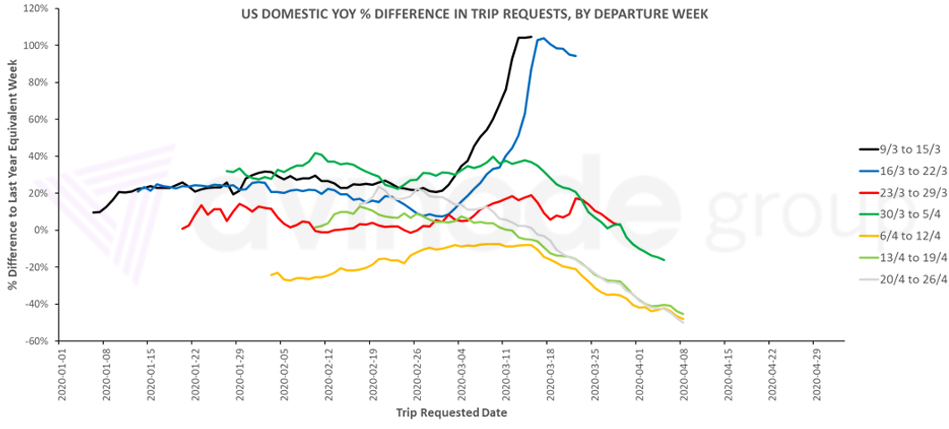

US domestic trip requests

The continuing escalation of the severity of the crisis in the US is being reflected in the data. The current week (orange), next week (light green) and the following week (light grey) are all suffering. Right now, there is no indication of when higher demand will return. As I explained last week, it is short duration flights that are suffering the most.

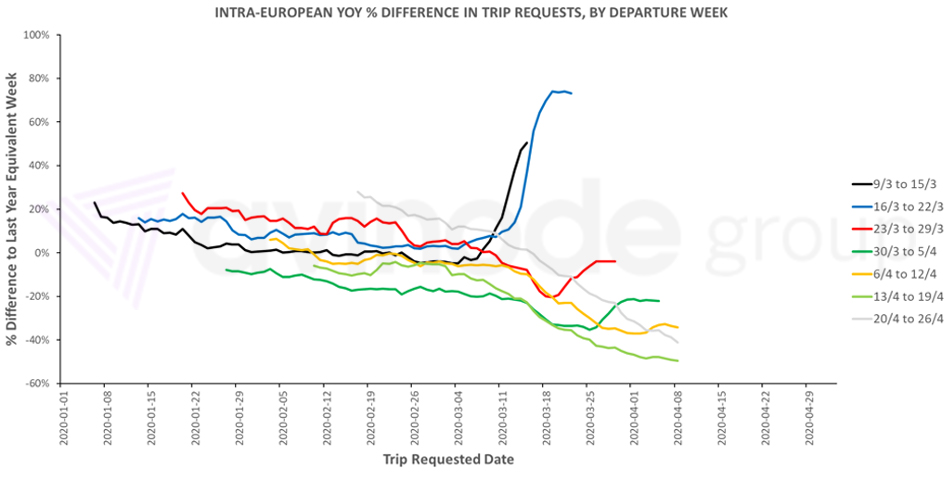

Intra-European trip demand

Intra-European charter trip demand is in a similar position, although there does appear to be a bit more close-in demand. Across 10th to 20th April, comparing to equivalent dates last year (this covers the Easter shift), arrivals into all major markets are suffering. The figure for Greece shows that airports in the Mediterranean, that may have not been impacted so far due to their strong seasonality, will start to feel the impact.

Interestingly Sweden has increased charter demand for this period compared to last year. Although it is hard to draw too many conclusions given this is a small amount of data compared to big European markets, perhaps it reflects the less stringent COVID-19 measures in place and the evaporation of commercial options.

“The figure for Greece shows that airports in the Mediterranean, that may have not been impacted so far due to their strong seasonality, will start to feel the impact.”

Long-term demand

Longer term, we don’t know where global demand will recover to. Lufthansa Group announced earlier this week that due to health worries and the economic impact, they don’t expect pre-COVID levels of demand to return for years. To prepare for this, they announced the early retirement of at least 40 aircraft, including nearly half of their A380 fleet, and the closure of an entire subsidiary.

With lower commercial demand, does that mean some passengers will pay to fly private instead? Or will health concerns impact private aviation negatively too? It is too early to answer these questions with any certainty.

Harry Clarke,

Head of Insight, Avinode Group